do i have to pay tax on a foreign gift

The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. Tax with no Income Davids parents are citizens of China.

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

If you happen to receive money from a foreign corporation or partnership as a gift and it is above.

. This rule stands for. If the donor does not pay the tax the IRS may collect it from you. Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons.

As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received. Paying Tax on Gifts Received from Abroad. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

However you may be required to furnish proof that you paid any estate or gift tax to a foreign government. The tax applies whether or not the donor. The same is true for those who receive an inheritance.

You will not have to pay tax on this though. They are non-US persons and neither of them have ever. While you may not need to pay tax on large sums of money being sent abroad.

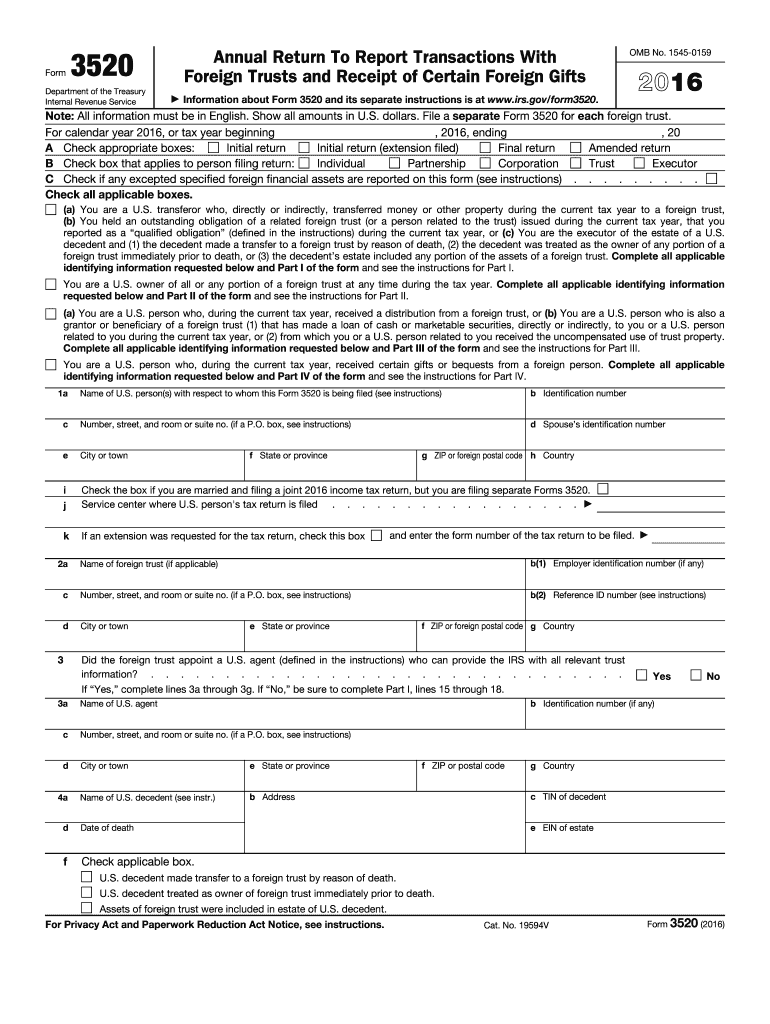

There is no income tax due on a gift of money unless it generates interest or a chrageable event gain. Typically if a foreigner gifts money or property except intangibles such as. Although youll pay no taxes youll file Form 3520 at tax time reporting all gifts received from overseas on that form.

However since the gift is from a foreign person you must report the gift received to. The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold. The burden of paying the gift tax falls on the gift-giver.

If this is the case these would need to be reported. In cases where gifts are taxable the sender is required to pay tax not the recipient. When money is transferred overseas as a gift you may not have to pay taxes on it.

The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due. In other words if a US. For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities.

Person receives a gift from a foreign person that specific transaction is not taxable. And you will not be required to pay an income or foreign gift tax. However if the gifts value is greater than a certain amount you may have an IRS reporting requirement.

There are no specific IRS taxes on gifts received from a foreign person. The fact that the gift is from a foreign person is irrelevant. You can gift up to 11180 million in your lifetime without owing this tax but youll.

No the gift is not taxable but it is reported on Form 3520. Again it is simply a declaration.

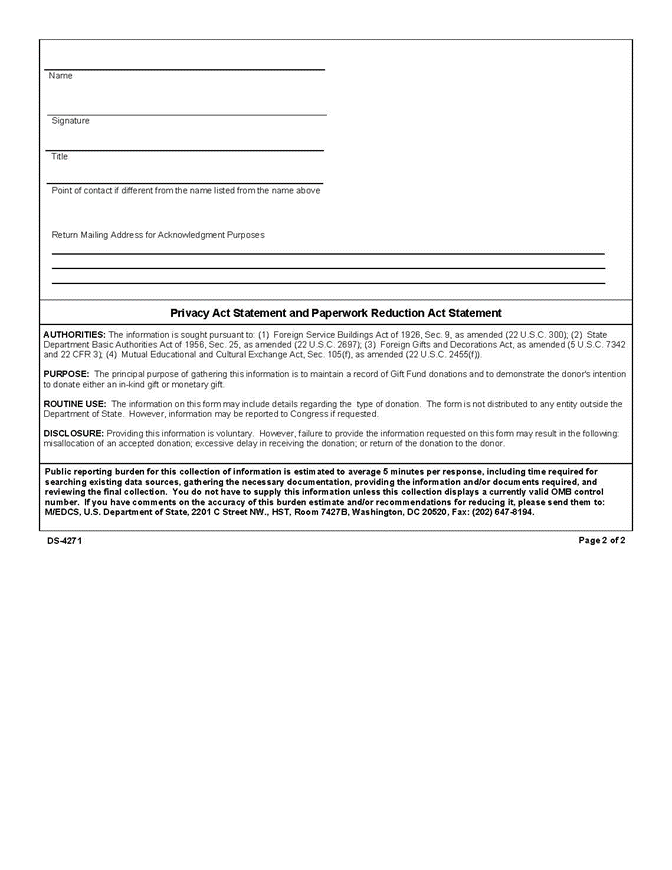

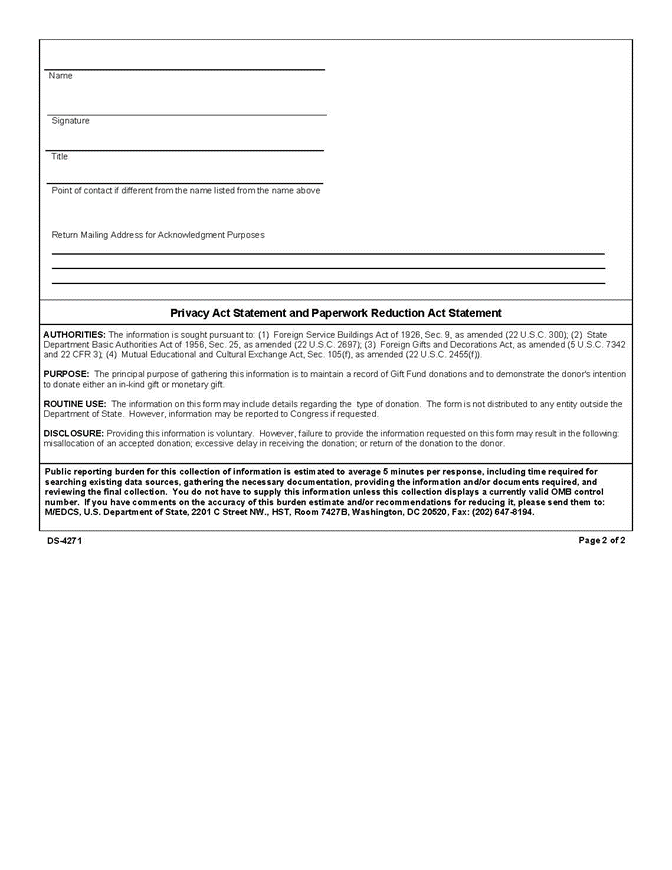

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

Do You Understand The Irs Gift Tax Rules Strategic Tax Planning Accounting Services Business Advisors Mst

Avoiding Taxes On Gifts By Foreigners Meg International Counsel Pc

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Irs 3520 2016 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tax Free Gifts For Real Estate Buyers Housekey Reduce Or Avoid Gift Tax

The Gift Tax Turbotax Tax Tips Videos

Reporting A Gift From A Foreign Source Taxcpe

The Gift Tax Made Simple Turbotax Tax Tips Videos

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

How To Report A Foreign Gift Or Inheritance Of More Than 100k Schwartz Schwartz Pc

Foreign Gift Reporting Requirements Henry Horne

Foreign Clients Take Care When Making Gifts This Holiday Season Insights Events Bilzin Sumberg

What S The Limit On Cash Gifts From A Nonresident Alien

Do I Have To Pay Taxes On A Gift H R Block

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate