why are reits tax efficient

The Tax Cuts and Jobs Act TCJA passed into law in 2017 further enhanced the tax efficiency. The 542 of my dividends that are qualified REIT dividends will now be 20.

Benefits Of Fmcg Crm Customer Relationship Management Crm Sales Process

Get your free copy of The Definitive Guide to Retirement Income.

. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. For this reason I recommend you hold your REITs in an. Contact a Fidelity Advisor.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. That provides a slight reduction in tax rates while simultaneously amounting to an after-tax savings. This section of the article examines why funds use REITs for the benefit of foreign investors how various types.

They buy the property collect the. Rather than having to buy and maintain actual physical real estate properties investors can. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives.

Their comparatively low correlation with other assets also. Tax-efficient investing can minimize your tax burden and maximize your returns. REITs pay out roughly 65 of their distributions.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. The bill featured a new 20 percent tax deduction for pass-through entities. Theres another reason to put REITs in tax-advantaged accounts.

While REITs may experience. Potential Market Inefficiency Due to the weird legal structure of. Contact a Fidelity Advisor.

ETFs are vastly more tax efficient than competing mutual funds. REITs Can Enter Real Estate Related Businesses to Boost Returns. Ad If you LIKE dividends youll LOVE Dividend Detective.

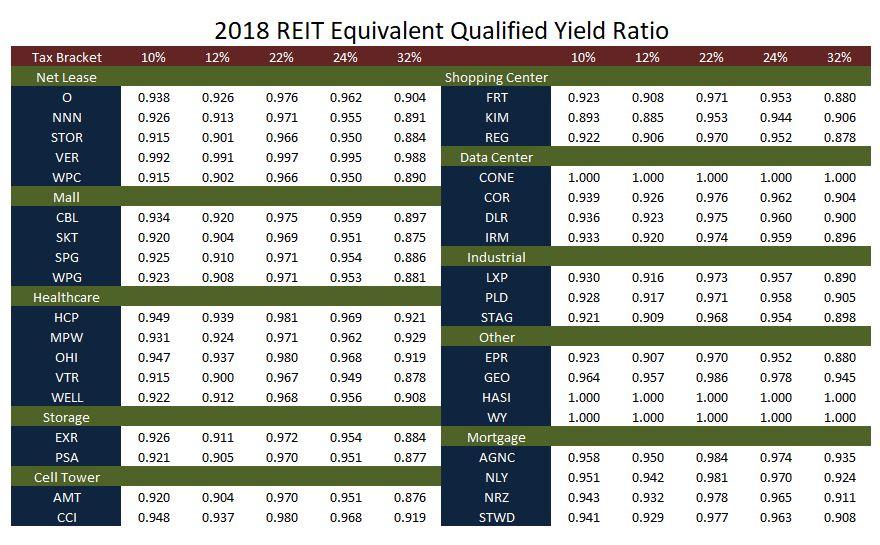

Shareholders may then enjoy preferential US. When looking at after-tax total returns the effective tax rate gap between REITs and corporates is typically much closer than generally perceived. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate. Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. An analysis of Burton G.

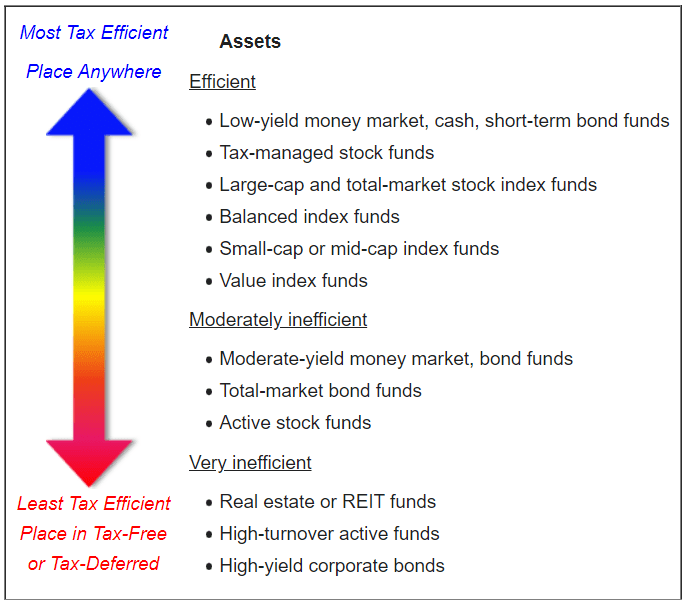

Theres another reason to put REITs in tax-advantaged accounts. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties. Find out why tax-efficient investing is important and how it can save you money.

Their dividend tax rate is much higher than dividends on stocks. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. Long-term capital gains are taxed at lower.

Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. REIT dividends are usually not considered qualified so they are taxed at whatever your marginal tax rate happens to be.

REITs historically have delivered competitive total returns based on high steady dividend income and long-term capital appreciation. Starting in tax year 2018 an additional benefit has been added to REITs thanks to tax reform. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

In exchange for paying out at least 90 of taxable income to shareholders REITs. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Further REITs recently became even more tax efficient under the new 2017 Tax and Jobs Cuts Act.

Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Tax rates on dividend distributions from the REIT. It can be a way for you to invest less capital so that in 5 10 or 15 years. Most private real estate investors are buy and hold investors.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

Sec 199a And Subchapter M Rics Vs Reits

Guide To Reits Reit Tax Advantages More

Guide To Reits Reit Tax Advantages More

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Ashok Mohanani Chairman Ekta World Mumbai News Quikrhomes 4 Words New World Word Search Puzzle

Rental Properties For Passive Income 5 Things I Wish I Would Have Known Fir Real Estate Investing Rental Property Real Estate Education Real Estate Investing

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits 101 Do You Know The Risk And Benefit Of Reits Investing Money Management Books Investing Strategy

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

According To Case Shiller Us Housing Has Paused On Its Way Down Marketing Set Housing Market Marketing

How Tax Efficient Are Your Reits Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

Best Tax Efficient Funds Seeking Alpha

Should You Invest In Reits Wealthfront

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors