property tax assessor las vegas nv

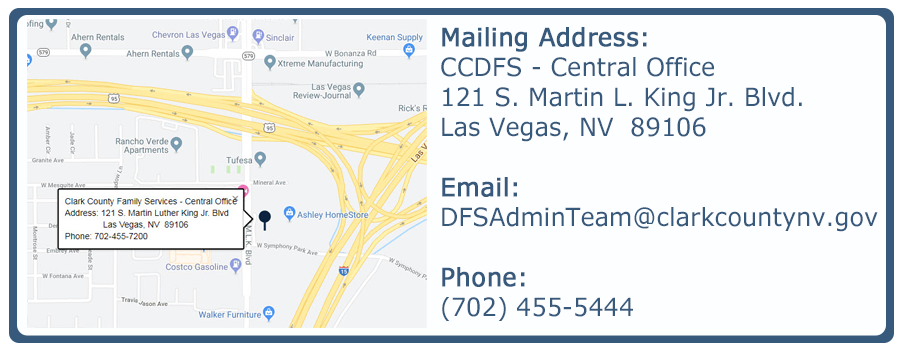

Use our link below for more information on our property tax exemption programs for Surviving Spouses Veterans Disabled Veterans and Blind Persons. Name Clark County Assessors Office Address 500 South Grand Central Parkway Las Vegas Nevada 89155 Phone 702-455-3882.

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Tax Rates for Nevada Local Governments Redbook.

. Nevada Administrative Code requires the Nevada Assessors to use Marshall Swift Building Cost. Henderson NV 89015 Get Map Closed Friday No DMV Services. Boulder City Bunkerville Enterprise Glendale Henderson Indian Springs Las Vegas Laughlin Mesquite Moapa Moapa Valley Mt.

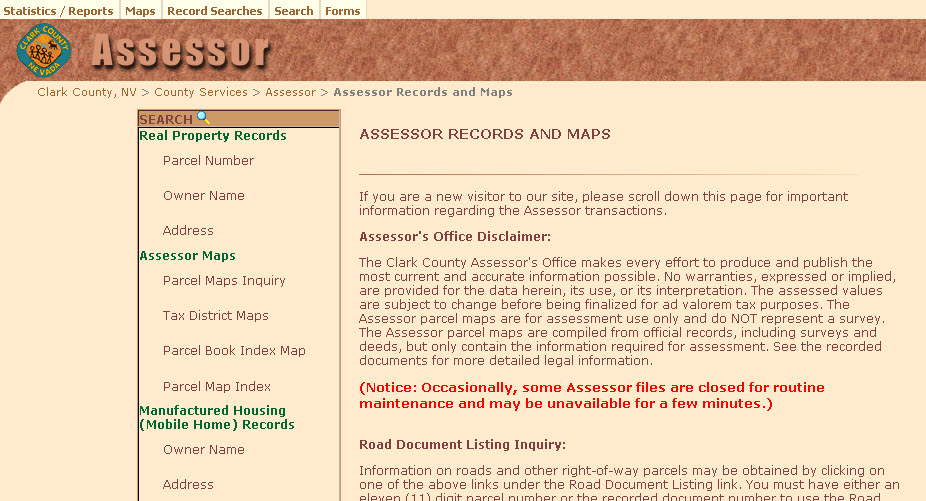

5404 WHISPER LAKE AVE. See the recorded documents for more detailed legal information. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

Whether you are already a resident or just considering moving to Las Vegas to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Assessor parcel maps are for assessment use only and do NOT represent a survey. Address and Phone Number for Clark County Assessors Office an Assessor Office at South Grand Central Parkway Las Vegas NV.

Clark County Assessor Clark County Government Center 500 South Grand Central Parkway Las Vegas NV 89155 Phone 702455-3882. General Median Sale Price Median Property Tax Sales. Parcel inquiry - search by Owners Name.

Show current parcel number record. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Big Horn Median Property Tax.

The surviving spouse of a disabled. Las Vegas NV 89155. Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60.

Grand Central Pkwy Las Vegas NV 89155 702 455-0000 Copyright 2021 Clark County NV Login. The amount of exemption is dependent upon the degree of disability incurred. The Assessors Office locates taxable property identifies ownership and establishes value for the tax assessment rolls.

Las Vegas NV 89129. HE WEN FU JUAN FANG. See reviews photos directions phone numbers and more for Property Tax Assessor locations in Las Vegas NV.

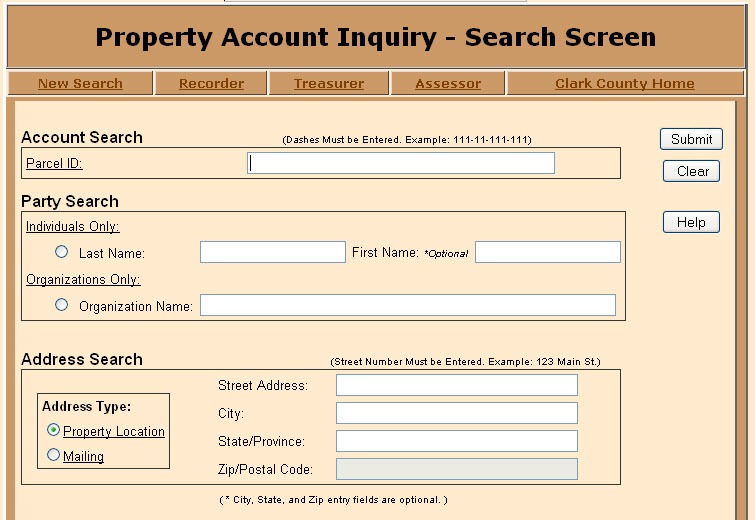

Big Horn - Street. Owner and Mailing Address. Or Company Name Last Name Required.

Owner and Mailing Address. The Assessor strives to keep property owners aware of their rights and. Public Property Records provide information on land homes and commercial properties in Las Vegas including titles property deeds mortgages property tax assessment records and other documents.

Grand Central Pkwy Las Vegas NV 89155 702 455-0000 Copyright 2021 Clark County NV Login. Ad Millions Of Las Vegas Property Records Are at Your Fingertips. One Simple Search Gets You a Comprehensive Las Vegas Property Report.

Grand Central Map Website. The Assessor parcel maps are compiled from official records including surveys and deeds but only contain the information required for assessment. House located at 5677 Mesa Mountain Dr Las Vegas NV 89135 sold for 455453 on Dec 18 2012.

The citizens of Nevada County deserve fair and equal implementation of California property tax laws and our goal is to ensure that taxpayers receive timely and accurate property assessments. General Median Sale Price Median. Occasionally some Assessor files are.

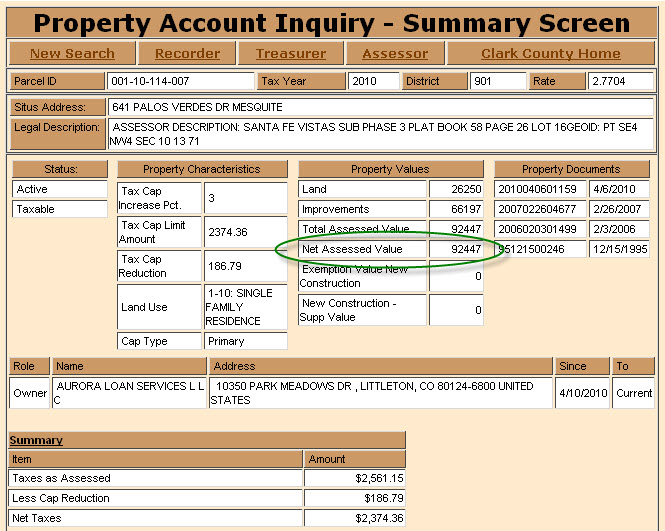

70000 assessed value x 032782 tax rate per hundred dollars 229474 for the fiscal year. The Assessor is required by Nevada law to assess all property every year. Las Vegas police released a missing persons poster Friday seeking assistance in finding Reynaldo Crespin.

Charleston North Las Vegas Paradise Searchlight Spring Valley Summerlin. This is referred to as the tax cap. Sign up to receive home sales alerts in Las Vegas Subdivision in Las Vegas NV.

Several government offices in Las Vegas and Nevada state maintain Property Records which are a valuable tool for understanding the history of a property finding property. Learn all about Las Vegas real estate tax. Check here for phonetic name match.

Information reflective of 2021 Recorder Assessor Data. The Assessor is required by law to assess all real property at current value which is represented by the replacement cost of the improvement less depreciation and market value of the land. AOCustomerServiceRequestsClarkCountyNVgov 500 S Grand Central Pkwy Las Vegas Nevada 89155.

Show present and prior owners of the parcel. If street number is entered results will include addresses within three 3 blocks. Please enter all information known and click the SUBMIT button.

To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada.

Taxpayer Information Henderson Nv

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Taxpayer Information Henderson Nv

Smith Wollensky Las Vegas The Saucy Culinarian Las Vegas Vegas Baby Vegas

818 Stewart Las Vegas Nv 89101 Las Vegas Property Records Property

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Las Vegas Area Clark County Nevada Property Tax Information

Mesquitegroup Com Nevada Property Tax

Clark County Assessor S Office To Mail Out Property Tax Cap Notices Youtube

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Logic Launches New Property Tax Appeal Division Logic Commercial Real Estate

Bill Proposing Property Tax Floor Increase Receives Icy Reception The Nevada Independent